If you listen to the radio, watch TV, or read the news, you are bound to hear countless reports on the status of the real estate market. The reports you hear, however, may not always be specific to the market you are in.

National trends are great indictors of the overall US real estate market, but what is true in one state is not always true in another. There can even be a great deal of variation in markets within the same state or even same county.

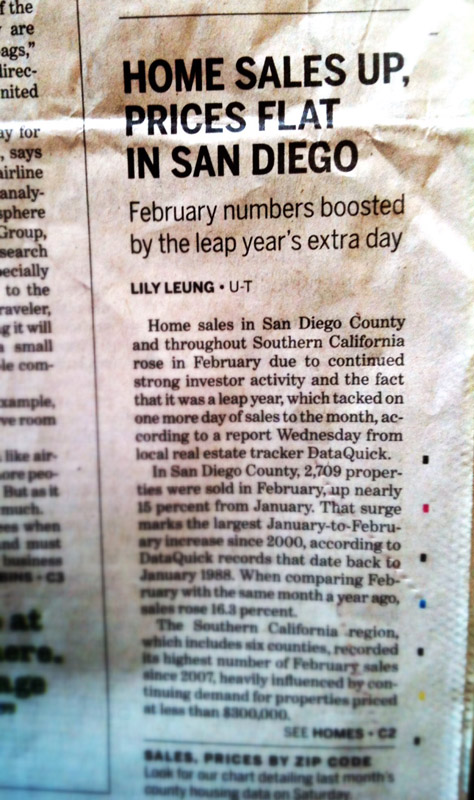

A recent article, found in the UT San Diego, shares information pertaining directly to the San Diego and Southern California markets for February 2012.

Much of this data comes from investors buying up the distressed properties on the market. The properties selling the quickest are those that are perceived to be the best deal to buyers, particularly investors.

Some of the interesting quotes from the article:

The Southern California region [. . .] recorded its highest number of February sales since 2007, heavily influenced by continuing demand for properties priced at less than $300,000.

In San Diego County, 2,709 properties were sold in February, up nearly 15 percent from January [2012].

The sale of lower-priced properties (less than $300,000) in Southern California increased 9.5 percent from a year ago. In the $300,000-$800,000 range, they fell 0.8 percent. In the $800,001-plus range, sales fell 12.6 percent.

Click the link above to read more from the article on the details of these recent statistics.

Leave a Reply